Vancouver fintech Hero Innovation Group (CSE: HRO) has launched Hero Financials, a full-service alternative-to-banking solution for Canadian kids, teens, GenZers, and their parents.

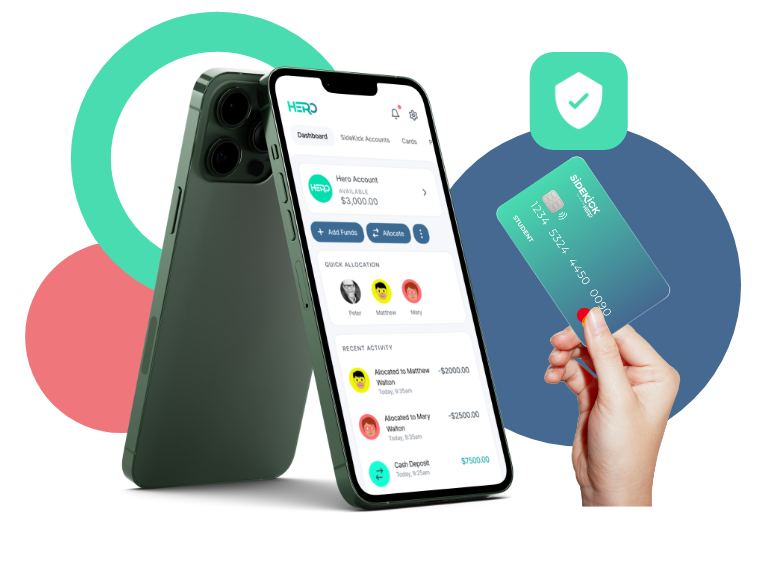

Hero allows kids and teens to make their own financial and spending decisions and set a strong foundation for themselves to make smart money decisions. The solution is paired with SideKick, a prepaid Mastercard that equips kids with vital financial literacy skills.

Hero provides the foundational steps that accompany kids into a financially independent and responsible future, while also building parent-child trust and confidence by eliminating the need to borrow parents’ credit or debit cards to access funds.

With Hero, transfers are sent in real-time, and funds can be used both in-store and online, via contactless and chip payments wherever a prepaid Mastercard is accepted. It can be used for purchases, savings and to gain essential financial literacy skills, without the limitations and restrictions imposed by traditional consumer banks.

“Being a Canadian company, presence in our home market is crucial for us. We identified a critical gap in the sector’s ability to meet the financial goals and needs of Canadian youth and GenZers, a segment that now comprises a fourth of our population,” said Peter MacKay, CEO of Hero Group.

“Hero Financials is the perfect turnkey solution for Canadian youth that compliments their journey towards gaining financial independence, while also helping parents support and pass on those valuable skills to their kids,” he added.

As a multi-user product, parents can receive notifications of their child’s spending in real-time, restrict and block purchases on items by product category and lock funds in their child’s account, which only they can later unlock.

Users will soon be able to take advantage of the Round-Up feature, whereby purchases are rounded up to the nearest dollar and the spare change is automatically deposited into a savings account, called Vault, for use later.

Hero will also soon support digital payments through a wallet function, whereby users can make payments from their Hero accounts via third-party mobile payment apps such as Google Pay, Apple Pay and Samsung Pay without the need to present a physical card for purchases.

Leave a Reply