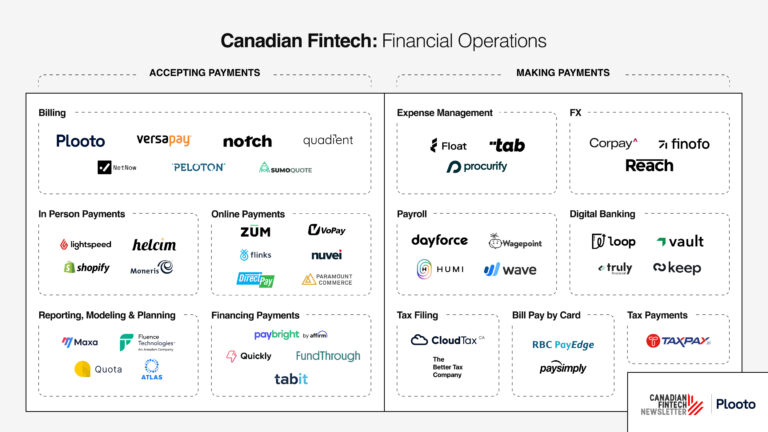

The fintechs in this market map are companies that power the CFO’s office. They allow businesses to issue invoices, process payments, manage expenses & run payroll. These are behind the scenes tools that quite literally allow businesses to send & receive money. [Read more…] about FinOps Market Map: Visualizing Canada’s Financial Operations Companies

Thought Leaders

Customer Satisfaction Is the Key to Successful Digital Banking Adoption

In a world where digital solutions are transforming industries at a breakneck speed, Canadian banks appear stuck in a bygone era. [Read more…] about Customer Satisfaction Is the Key to Successful Digital Banking Adoption

A Pathway to Greater Efficiency for Canadian Finance Leaders

Earlier this year, the Bank of Canada noted an urgent need for the country to elevate its productivity levels. Improving productivity through efficiency, can allow our economy to grow faster and lessen the risk of inflation. Encouragingly, this is an achievable scenario. [Read more…] about A Pathway to Greater Efficiency for Canadian Finance Leaders

Why Fintech Brands Are Using TV To Cut Through the Competition

The media environment in 2024 continues to present more complexity for marketers looking to capture audiences, drive traffic, and build awareness and brand presence. These intersecting objectives need to be tailored to the marketer’s audience and narrowed to reflect unique initiatives within the brand’s scope. [Read more…] about Why Fintech Brands Are Using TV To Cut Through the Competition

The Future of Authentication Is Without Passwords

If you’re like most people, you have dozens, if not hundreds of online accounts for everything from banking and shopping to watching movies, listening to music or keeping up with your friends through social media. [Read more…] about The Future of Authentication Is Without Passwords

Exploring the Trends Driving Change in Payment Processing

The payment processing industry is rapidly evolving due to digital advancements, with over 85% of retailers in the U.S. and Canada presently accepting Apple Pay. [Read more…] about Exploring the Trends Driving Change in Payment Processing

2024 Content Marketing Trends for Fintech Companies

2023 was a year where marketing teams in all verticals had to be more strategic and creative with their dollars – particularly for teams within the fintech and financial services space. [Read more…] about 2024 Content Marketing Trends for Fintech Companies

Canada’s Reluctance To Embrace Open Banking Is Widening the Innovation Gap

Since the creation of online banking in the early 2000s, there hasn’t been a whole lot of progress in the Canadian banking system, and other countries are zooming ahead. [Read more…] about Canada’s Reluctance To Embrace Open Banking Is Widening the Innovation Gap

Why Canada Is an Ideal Country to Soft Launch a Brand in North America

For over 20 years Kingstar Media has operated as a gateway to the Canadian market for hundreds of international brands such as Trivago, Zip Recruiter, NordVPN, Vistaprint and many more. [Read more…] about Why Canada Is an Ideal Country to Soft Launch a Brand in North America

Network Tokenization: The Future of Secure Payments for Digital Businesses

Convenience and security go hand in hand in today’s technology-driven society; the need for advanced payment technologies has never been greater. Customers and merchants alike demand robust solutions that safeguard sensitive payment information. [Read more…] about Network Tokenization: The Future of Secure Payments for Digital Businesses