If you’re a client of a Canadian financial services company like Borrowell, EQ Bank, Mogo, or Tangerine, you may owe that relationship to Fintel Connect.

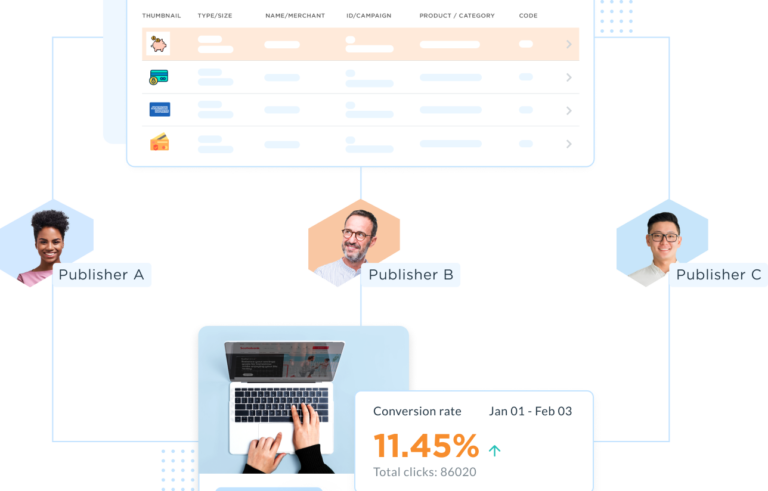

More than 50 financial service brands use the Vancouver-based startup to enhance their marketing through its performance marketing network.

“Our technology is helping consumers uncover product solutions from leading financial institutions and fintechs that solve their unique financial problems,” says founder Nicky Senyard. “In our current economic climate, this is more important than ever.”

Founded in 2019, the startup launched in 2020 and was named to Rocket Builders’ 2021 “Ready to Rocket” list.

This has now proven true as the BC company recently announced seed funding to fuel its next stage of growth.

The funding round was led by strategic investment firm BankTech Ventures based in the US and was supported by Canada’s export credit agency Export Development Canada. Established in 2021, BankTech Ventures is the first venture fund created for and by leaders in community banking, bank technology, and fintech.

Leveraging this capital influx, Fintel plans to scale its offering, fast-track new features along the product roadmap, and grow partnerships within the US market, according to a statement from the company.

“The support of BTV and EDC will give us even more momentum to help our branded financial partners deliver solutions to customers in need,” stated Senyard.

The amount of capital raised was not disclosed.

“Community banks need to be armed with the right capabilities and partners to reach their growth potential,” believes Carey Ransom, Managing Director of BTV. “It was quickly apparent to our team that Fintel Connect’s digital marketing expertise and technology were unparalleled, and their commitment to helping community banks to succeed was evident. “

“Fintel’s solutions are disrupting the way financial [institutions] approach digital growth,” agrees Jacqueline Ovens, Managing Partner of Mid-Market Lending & Investments for EDC. “The company’s products facilitate the acquisition of digital customers in a more effective, and cost-efficient manner.”

Headquartered in Vancouver, Fintel Connect currently has 41 employees.

Leave a Reply