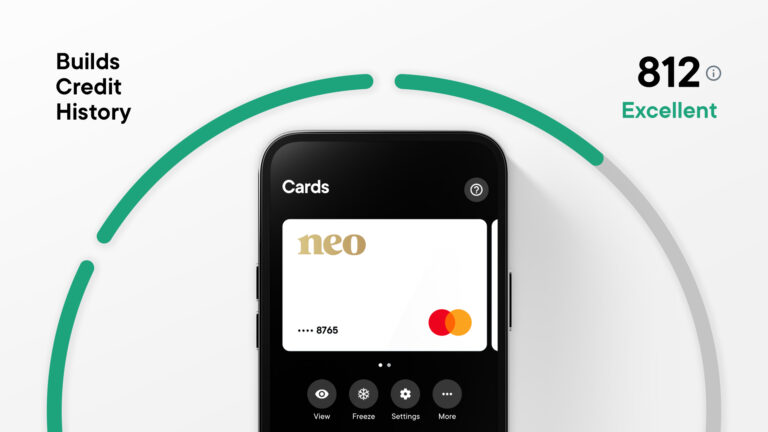

Calgary’s Neo Financial has introduced Neo Secured Credit; a card designed to help Canadians build credit with guaranteed approval.

This innovative product caters to those who have difficulty obtaining credit, seek to improve their credit score, or prefer to spend within their means.

Cardholders can now set their own credit limit and start building credit history with a secured card that earns instant cashback. Plus, purchases made with the card earn an average of 5% cashback at over 10,000 rewards partners with the option to add additional perks on the card at any time.

Neo is building financial tools for all Canadians and this product expands its suite of offerings that empower customers to choose the right card for their needs.

Recognizing that Canadians shouldn’t have to pay to build credit history, this card offers customers the ability to build credit. Opening an account is hassle-free and can be done in just a few minutes, requiring no hard credit check (except in Quebec where a check is required).

“Neo Secured Credit sets itself apart from other secured credit cards by unlocking premium features and rewards for all Canadians, regardless of their credit history,” said Andrew Chau, Co-founder and CEO of Neo Financial.

“We’re thrilled to continue to help Canadians build credit history and meet their diverse financial needs in our commitment to build a better financial future.”

Neo Secured Credit grants cardholders the flexibility to increase their credit limit at any time and manage their finances with real-time spend insights.

The versatile cashback feature allows customers to pay off statement balances, purchase exclusive items in the Neo Store or add to savings in the Neo Money account.

By using the card for everyday purchases, cardholders can build credit with transactions they typically make and set up autopay so they never forget to pay their statement.

Leave a Reply