Canadians continue to be either unaware of, or confused by, the concept of open banking.

As Canada’s government continues to lag behind the US, UK, and other regions on adopting open banking, private companies have been doing what they can to push the protocol forward.

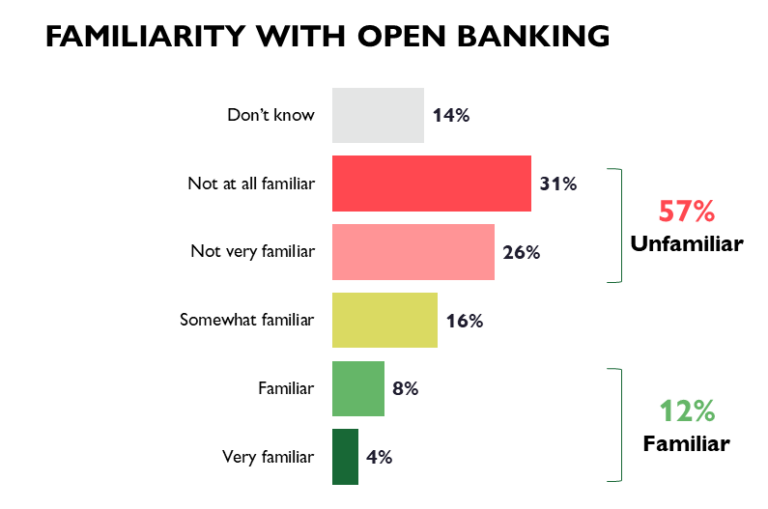

When it comes to open banking, 57% of Canadians acknowledge being unfamiliar with the concept, according to recent data from Abacus Data—while a mere 12% claim some familiarity.

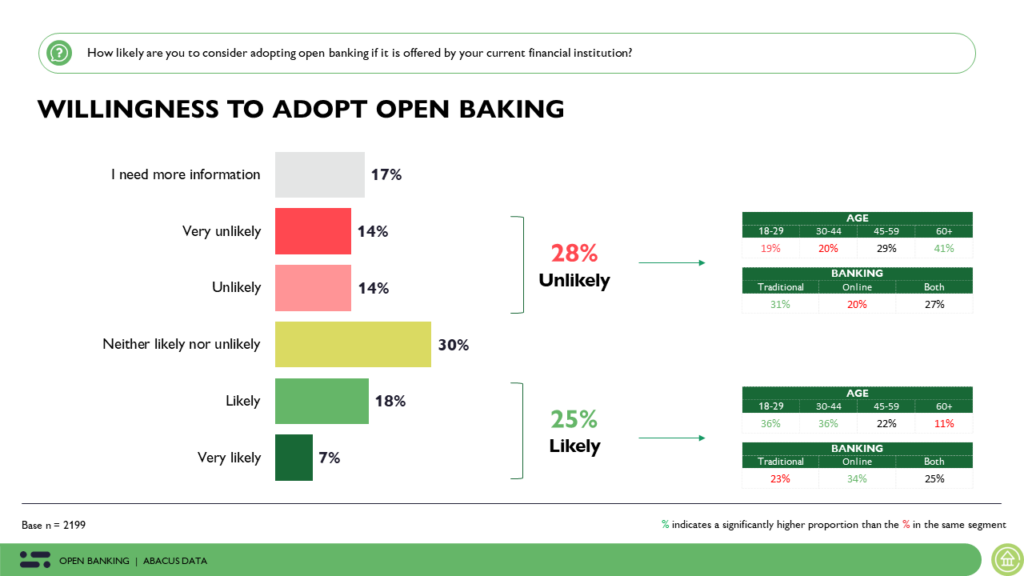

Naturally, there is a generational divide, with those under 44 years of age being on average more aware of open banking than older Canadians, who are less likely to engage to online banking.

Canadians’ main concerns with open banking revolve around data security (63%), privacy (62%), and unauthorized access to their personal information (54%).

“Given these apprehensions, it’s necessary for open banking solutions to prioritize innovation while ensuring consumer protection and data security measures,” writes Eddie Sheppard, who serves as vice president of insights for Abacus.

Canadians’ concerns about open banking likely stem from a lack of knowledge, Sheppard offers. Poll data shows that fewer than one-third claim proficiency in financial literacy and only 15% demonstrate familiarity with financial technologies.

Yet open banking holds the potential to boost security, not erode it. For example, data sharing can enable real-time fraud detection.

Perhaps Canada’s government is slow to adopt open banking simply because it knows demand is cool.

“At present, open banking lacks substantial demand,” Sheppard writes. “The challenge with open banking is that many Canadians don’t understand it and, as a result, they are resistant to embracing it.”

Citing a “widespread lack of understanding among many Canadians,” Sheppard points to a pattern reflected in past technological advancements: we were initially hesitant to normalize email, smartphones, and online shopping, for example.

“In each instance, initial resistance gave way to widespread acceptance as people recognized the benefits of these innovations,” says Sheppard.

That may be true, but so far awareness of open banking is making limited progress at best in Canada. Financial Consumer Agency of Canada research from 2023 suggested 15% of Canadians were aware, a figure slightly higher than Abacus found in 2024.

Of course, it may not even matter.

Overall, fostering digital literacy and advancing open banking awareness “are crucial steps towards creating a more inclusive and resilient financial ecosystem in Canada,” Sheppard concludes. “By addressing these key areas, the industry can better equip Canadians to navigate the complexities of modern banking and improve their financial well-being.”

Leave a Reply