In traditional industries like financial services, knowledge can feel stuck.

Existing knowledge bases weren’t designed for modern LLMs, and the time it takes for marketing and support teams to access information can negatively impact retention, loyalty, and sentiment.

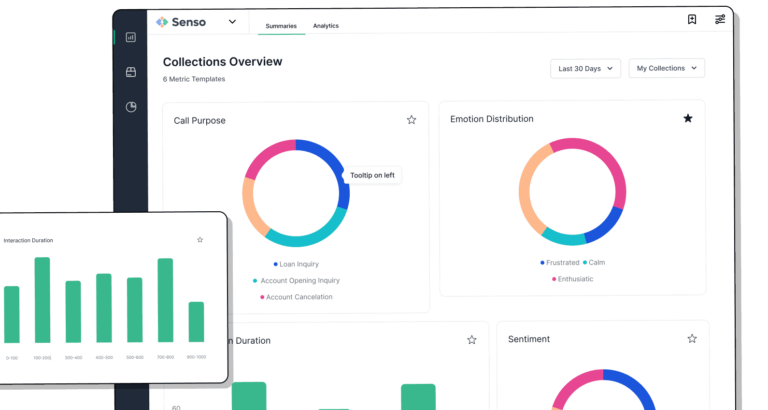

To address this problem, Senso is building an AI-powered knowledge base to expand customer relationships for traditional enterprises, starting in the Credit Union space.

“Our initial focus is on highly regulated sectors, where the slightest inaccuracies can lead to significant regulatory fines,” the Toronto-based fintech says.

The startup was established in 2017 by technology entrepreneur Saroop Bharwani and AI enthusiast Thomas Nelson.

The Canadian company’s flagship product claims to reduce contact time by 10x by enabling support teams to make decisions about customer requests in seconds.

The fintech leverages the latest in AI technology to help organize knowledge and documents, surface customer intent, unlock staff intelligence, and more.

Senso recently graduated from Y Combinator’s latest cohort of startups with a go-to-market strategy that involves partnering with industry leaders to distribute their product.

“In the Credit Union space, we’ve partnered with CU 2.0 to launch an industry-specific version of Senso called CuCopilot, built using our APIs,” the company says.

Bharwani described his experience at YC as “life-changing.”

Moving forward, the fintech is also eyeing expansion into other industries.

“We’re having the time of our lives building Senso,” Bharwani stated on LinkedIn, “and we’re just getting started.”

Silicon Valley technology startup accelerator Y Combinator has been used to launch more than 4,000 companies since the program was established in 2005.

Leave a Reply