Investment in Canada’s financial technology sector dipped last year, new data from PitchBook shows.

Valuations declined more than five-fold and the number of deals slowed significantly toward the end of the year—although it was still the second-best year for deal volume, according to data compiled by PitchBook for KPMG in Canada.

Let’s dive in to the data.

Fintech Figures

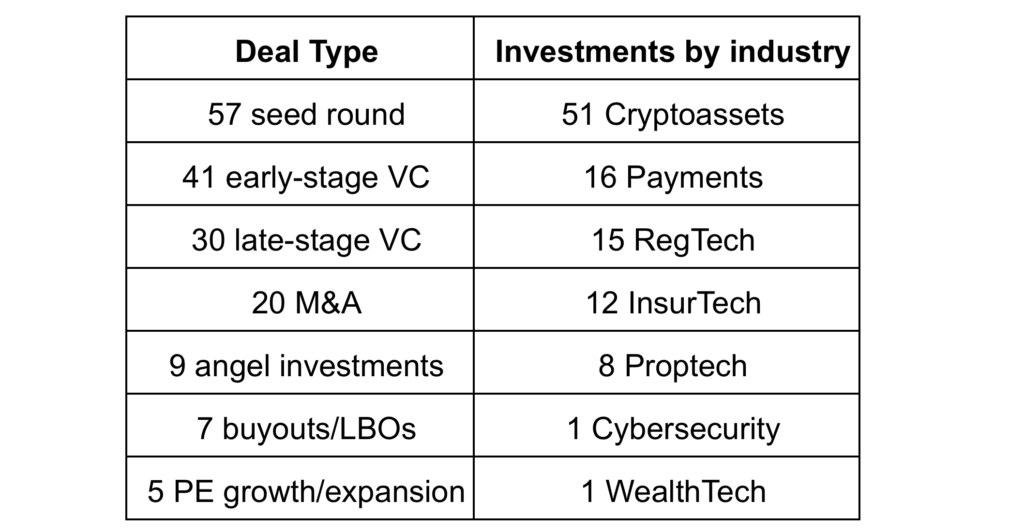

Canada’s fintech scene saw 169 investments worth US$1.3 billion in 2022. These figures are down from a record 217 deals worth US$7 billion in 2021.

“It’s not surprising to see a decline given the market rout, and the fact that fintech investments hit such feverish heights in 2021,” explains Geoff Rush, who serves as Financial Services Industry Leader for KPMG in Canada.

But to put things into perspective, he says, “last year’s activity was still stronger than 2020, and we also saw the second highest number of deals ever—so clearly investors were still finding many attractively priced opportunities.”

Seed round and early-stage investments drove more than half of last year’s activity, with 57 investments across the seed through Series B stages.

“The number of seed round and early-stage investments is a positive sign for the strength of Canada’s fintech ecosystem going forward,” Rush added.

Momentum from 2021 all but dried up by the fourth quarter of 2022, seeing just 27 deals worth US$150 million. This is compared to the year’s first quarter, which saw 41 deals worth US$285 million, according to PitchBook data.

Why the downturn? A slump in Canadian and global markets “put downward pressure on valuations last year,” which is a trend expected to continue this year.

“A potential recession, rising interest rates, and inflationary pressures are top of mind for investors,” warns Georges Pigeon, a partner in KPMG in Canada’s Deal Advisory practice who specializes in financial services.

Pigeon expects “valuations and deal volumes to remain subdued through 2023, with a slight pickup near the end of the year.”

The decline in fintech investments in Canada mirrors a global trend, with some differences across sectors.

For example, payments remains a hot sector globally, while crypto assets and blockchain companies garnered interest in Canada despite a year of volatility from the collapse of some coins, exchanges, and lenders.

Mentality Shift

According to Pigeon, Canada’s financial technology space is currently undergoing a “mentality shift.”

“In 2021, many companies saw a huge influx of capital from VC investors, so some of those firms won’t need cash until sometime in 2023—maybe even 2024—because they’ve streamlined and restructured their operations to make that cash last longer,” he says.

Instead of a growth-at-any-cost mentality, “many fintechs are now focusing on sensible growth while preserving the cash they have on hand for as long as they can with an eye to achieving sustainable profitability in a not-too-distant future,” believes Pigeon.

Overall, fintech remains in a strong position in Canada, though faces several forces of change, a recent report from Accenture found.

I think a chart showing how Canada’s fintech sector fared in 2022 compared with other comparator countries’ would be helpful.