A new report reveals that individuals rank financial wellness as their top life concern, surpassing physical and mental health as well as family relationships.

The global survey from Personetics, a fintech based in the U.S. and Israel, found that consumer demands around banking are evolving rapidly.

The report, titled “Understanding Consumer Demand in the AI-Banking Era,” reveals that 84% of respondents implied a willingness to switch banks in order to receive sufficiently convenient services.

Today’s comprehensive personal banking insights and timely product recommendations necessitate AI-driven features to achieve this level of service, posits Personetics.

“Today’s consumers are digitally savvy and expect advanced, personalized banking experiences,” explains Udi Ziv, chief executive officer of Personetics.

“Banks must meet this demand by providing comprehensive, needs-based services that leverage AI-driven insights and advice to assist their customers in making smarter financial decisions,” Ziv continued.

“Banks are discovering that these services enhance customer loyalty and, consequently, drive product sales, demonstrating that financial wellness benefits everyone involved,” stated the CEO. “These services are not merely optional for banks; they are essential.”

In 2025, Canadians expect their financial institution to “proactively analyze and understand their financial situation and needs according to their daily spending and saving habits,” according to the survey of 2,000 banking customers across North America and other regions.

The demographic most-demanding of modern fintech features is unsurprisingly the youngest group, who overwhelmingly seek out intelligent, digital-first banking solutions. But the demand is evident across categories.

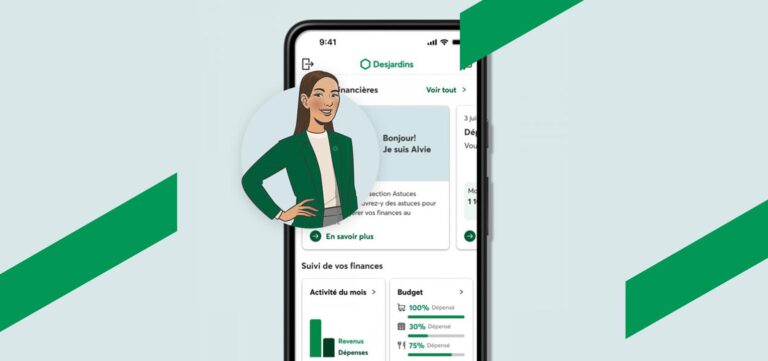

We’re seeing this play out in real time. For example, when Desjardins saw that a majority of their members had gone digital, the Canadian financial institution launched Alvie in 2024, an AI-powered virtual assistant.

“Our members are increasingly online, especially on mobile,” Etienne Chabot, Digital Transformation Manager at Desjardins, explained in January. “We wanted to provide personalized financial management capabilities exactly when and where our members needed them, not through monthly statements requiring manual consolidation.”

Personetics supports 150 million customers across 35 global markets. The firm has been powering fintech solutions in Canada for several years.

Leave a Reply