Japan’s Monex Group has acquired Toronto-born 3iQ Digital Asset Management. [Read more…] about Japan’s Monex Group Acquires Majority of Canadian Crypto ETF Pioneer 3iQ

Tetra Trust

Tetra Partners with Figment to Bring Staking Services to Canada

Calgary’s Tetra Trust, a leading Canadian provider of crypto custody, has partnered with Figment, a global expert in staking solutions, to provide digital asset staking services to institutional clients in Canada. [Read more…] about Tetra Partners with Figment to Bring Staking Services to Canada

Tetra Trust Launches New API to Provide Customers with Enhanced Custody Solution for their Digital Assets

The digital assets landscape has been challenging to all industry players over the past year with the FTX collapse in late 2022 being a trigger point. [Read more…] about Tetra Trust Launches New API to Provide Customers with Enhanced Custody Solution for their Digital Assets

Stablecorp Responds to Market to Re-Launch QCAD Stablecoin

Stablecorp, a digital asset infrastructure company headquarted in Toronto, is re-launching its popular QCAD stablecoin. The company has partnered with Calgary’s Tetra Trust to provide transparency and industry-leading reserve structuring for the stablecoin. [Read more…] about Stablecorp Responds to Market to Re-Launch QCAD Stablecoin

Do You Know How Your Digital Assets Are Safeguarded?

Are your digital assets safe? Is the crypto trading platform you use functional, viable and regulated? Are you able to access your digital assets at any time? [Read more…] about Do You Know How Your Digital Assets Are Safeguarded?

Q+A with Tetra’s Steve Oliver on How Regulations Spur Innovative Compliance Solutions for Digital Assets

Stephen Oliver is the Chief Compliance Officer for Tetra Trust Company, a Calgary-based regulated digital assets custodian serving the Canadian market. Steve is also an instructor at the University of Calgary, where he lectures on corporate governance. [Read more…] about Q+A with Tetra’s Steve Oliver on How Regulations Spur Innovative Compliance Solutions for Digital Assets

MeetAmi Partners With Tetra Trust To Offer Compliant Digital Asset Wealth Management

Calgary’s Tetra Trust and Vancouver’s MeetAmi are partnering to offer a turnkey solution to Canada’s wealth management market, offering the ability to invest in Digital Assets and hold the asset base with a qualified Canadian custodian. [Read more…] about MeetAmi Partners With Tetra Trust To Offer Compliant Digital Asset Wealth Management

Q+A with Accelerate CEO on how Investors can Invest Safely in NFTs

Julian Klymochko is founder and CEO of Accelerate Financial Technologies, a fast growing alternative investment solution provider. The Calgary-based firm announced an NFT Fund for investors earlier this year and recently purchased several new “blue chip” NFTs. [Read more…] about Q+A with Accelerate CEO on how Investors can Invest Safely in NFTs

Accelerate Promotes NFT Fund With Heightened Focus On Security For Investors

The current crypto crash and burn for FTX isn’t slowing down all parties in the Web3 world. Some companies are taking the time to remind investors of their digital asset products, but with an extra focus on how they are kept safe, secure and can be reliably withdrawn. [Read more…] about Accelerate Promotes NFT Fund With Heightened Focus On Security For Investors

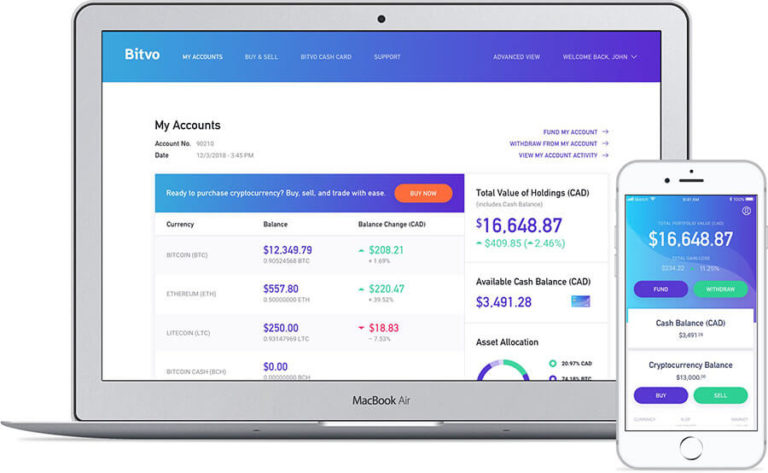

Calgary’s Bitvo Dodges Bullet with Stalled FTX Acquisition due to Canada’s Strong Regulatory Environment

Last summer Fintech.ca reported that crypto asset trading platform Bitvo was being acquired by FTX, the world’s 5th largest crypto exchange. [Read more…] about Calgary’s Bitvo Dodges Bullet with Stalled FTX Acquisition due to Canada’s Strong Regulatory Environment