Wealthsimple is continuing to increase access to alternative assets for retail investors with its latest offering.

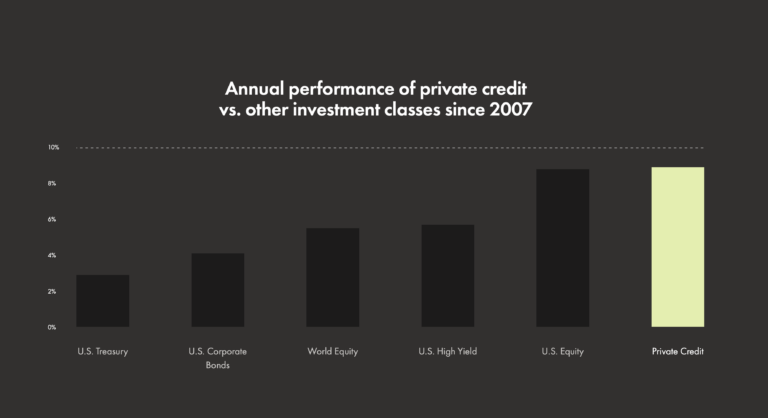

The Toronto fintech is launching Wealthsimple Private Credit. In partnership with alternative asset manager Sagard, the private credit fund is promising monthly payouts with a 9% annualized yield—”designed to outpace other high-yield investments,” according to a statement from the company.

The move, alongside other alternative asset investing innovations in Canadian fintech, appears spurred by rising interest rates during a stock market cooldown.

“If you’re invested in a portfolio of stocks and bonds, adding private credit can optimize your performance—especially when interest rates are up,” Wealthsimple says.

While access to retail investors is increasing, restrictions are still in place. You can buy individual penny stocks as a regular Wealthsimple user, for example, but minimum account amounts will determine who is eligible for private credit investing.

“Institutional-grade private credit used to be off-limits to all but the wealthiest and most well-connected investors,” explains the fintech. “Now Wealthsimple clients with deposits of $100,000 or more across their accounts can add it to their investment plan with the guidance of their portfolio manager.”

According to Wealthsimple, the investment “primarily targets senior secured credit.” The company also promises “due diligence on each investment.”

Private credit investing builds on Wealthsimple’s Venture Fund I, which launched last year to enable everyone to play the long game of venture capital.

“Things like real estate, venture capital, and private equity can help diversify a typical equity portfolio and provide attractive returns, but they often aren’t available to those who don’t have millions to invest,” Wealthsimple’s Chief Investment Officer, Ben Reeves, noted last year. “Our whole reason for existing is to make the tools of wealth broadly accessible.”

Power Corp, which owns Sagard, also holds a stake in Wealthsimple.

Leave a Reply