Canada’s finance sector is a “textbook case of an industry primed for disruption by fintech,” according to a new report from McKinsey & Company.

The report from McKinsey, analyzing both hard data and insight from experts (including Fintech.ca editor-in-chief Rob Lewis), outlines several reasons why.

We break them down below.

Banks are Large and in Charge

Banking revenue accounted for 8% of Canada’s GDP in 2023, well above the 5.8% figure found in the US (which compares much closer to the 5.6% average of other developed economies).

And incumbent banks aren’t just big on revenue, but profit too, with margins higher than those found among banks in comparable economies.

On top of that, Canada’s banking industry is highly concentrated: the top five banks generated more than three-quarters of banking revenue in 2022.

This level of market concentration is “often a sign that innovators are itching to shake things up,” according to the report.

But there’s more.

Technology Penetration is High…

Canada ranks among the world’s top five countries for a range of tech-adoption measures, including smartphone penetration, internet usage, and higher education levels (which studies suggest correlates with more readiness to embrace new technologies).

All of these metrics suggest that Canadians should be willing, if not eager, to adopt modern financial technology services en masse.

Which brings us to our final point on the matter.

…But Fintech Adoption Lags

Despite being a nation of overly educated internet addicts, Canada appears to be lagging comparable countries with regards to consumers adopting newer fintech platforms over traditional banks.

“Canada ranks among the bottom five developed countries for adoption of digital banking, digital B2B services, and fintech solutions,” the report laments. “Only 13 percent of Canadian banking consumers use fintechs, for example, compared with 32 percent of those in the United Kingdom and 42 percent in the United States.”

Unlocking Major Potential

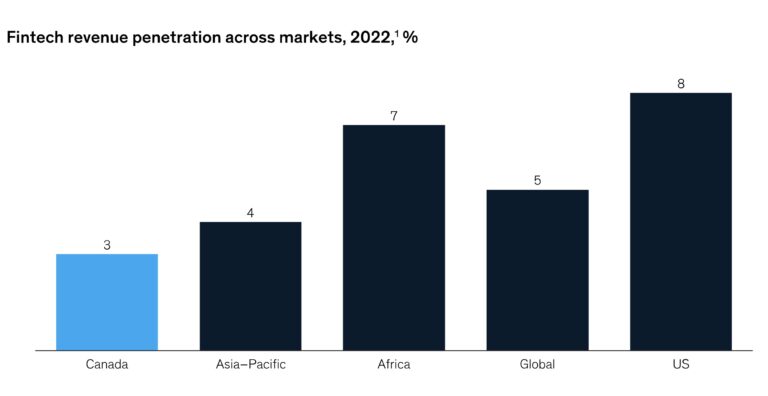

Of Canada’s $135 billion in banking revenues in 2022, just 3% were fintech-related. In the US, meanwhile, fintech penetration is at 8%.

Bridging that gap would mean billions more dollars in annual revenue for Canadian fintechs.

Canada’s situation is therefore one of “huge untapped potential,” according to the McKinsey report.

Suggested Solutions

The McKinsey report points to several factors to spur momentum of fintech adoption in Canada.

We highlight some below.

Partner Up, Please

In the early days, there was tremendous friction between incumbent banks and fintech startups.

Much of that friction has melted away as both parties now view each other as opportunities for collaboration.

“Partnerships between the two parties are more often seen as mutually beneficial and have thus become common in many developed markets,” the report reads.

However, “in Canada, partnerships remain scarce.”

One major key to more partnerships, according to the report, will be a greater awareness of the benefits of collaboration.

Finding Fresh Funding

Growth of the fintech sector “inevitably depends upon the availability of capital to support growing companies,” McKinsey’s report states, “and while there is no shortage of Canadian venture capital, the US fintech market remains a primary target for investors due to its larger size and maturity.”

Between 2017 and 2023, VC funding for Canadian fintechs grew at less than 2% percent per year, on average, compared with 18% in the United States.

Earlier-stage funding is likely to grow alongside investor confidence as more fintechs grow and complete successful exits, McKinsey’s analysis concluded, adding that the founders of successful buyouts may become angel investors in new startups.

Much depends on fintechs themselves, of course.

“Investors are more likely to back companies that create disruptive products and valuable intellectual property that prove competitive on a world stage,” the report reads, warning that many local investors feel Canada currently suffers from a plague of “too many ‘me too’ products and solutions.”

Target Newcomers

Canada has a remarkably high banking inclusion rate at98%, which means most current residents are already sufficiently banked.

But with the highest per-capita immigration rate in the world, Canada is welcoming a regular influx of new people—the vast majority of whom require banking services soon upon arrival.

Targeting this demographic with specific products could prove a boon for some fintechs, the report suggests.

Opening Up Banking

The Canadian government has been painfully slow to adopt official open banking protocols, but the regulatory environment may finally be changing.

The federal government has signalled intention to introduce open banking framework legislation in 2024 and it is working to establish a real-time payments system.

The government began a consultation process to consider measures it could take to strengthen competition in the financial sector, including measures that support fintechs.

These changes could help unlock faster growth in the sector, increase competition, and reduce costs for consumers, the McKinsey report says.

Leave a Reply