One of Canada’s premier venture capital firms this month released their annual report analyzing the state of the software sector across the country.

iNovia Capital’s “State of Canadian Software” tracks many metrics and provides numerous insights into the nation’s tech ecosystem, including the rapidly growing field of fintech.

“This year’s report dives into how the industry adapts to global trends while seizing growth opportunities,” writes iNovia cofounder Chris Arsenault in his report’s executive summary.

“From the rise of the AI supercycle fueling a startup boom to Canada’s leadership in quantum technology, to the strong momentum in Western Canada, and Ontario’s emergence as a global tech talent hub, Canada is punching above its weight on the global stage, with technology driving an increasingly diverse and competitive economy,” he stated.

One heavy-hitter is fintech, which the report defines as the “Innovative use of technology in the financial sector to enhance and streamline financial services.”

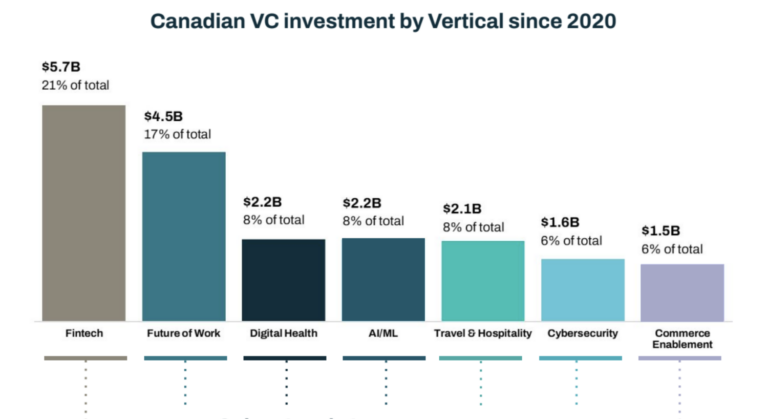

2024 is noted as a “blockbuster year” for many Canadian fintechs, but the momentum isn’t new. The report shows that fintech as an industry has garnered by far the most venture capital among tech sectors since 2020. Fintechs raised nearly $6 billion in financing from 2020 through 2024, comprising more than 20% of all private capital flowing into tech.

By comparison, Digital Health startups secured $2.2B over the same time frame, while Cybersecurity firms snagged $1.6B in total.

The report also revealed the biggest fundraising deals of the year for fintech. Neo raised US$260M; KOHO secured $140M; Brim Financial garnered $63M; ZayZoon raised $50M; and Float snagged $49M.

Overall, fintech innovation has been a driving force behind Canada’s growth in tech over the past decade while attracting a substantial portion of venture capital.

Leave a Reply