For more than a century businesses depended on paper-based processes to review and approve credit. Those old processes have hardly been updated—and they are “inefficient and require significant time and resources to even accomplish mediocre outcomes,” according to Nectarine Credit.

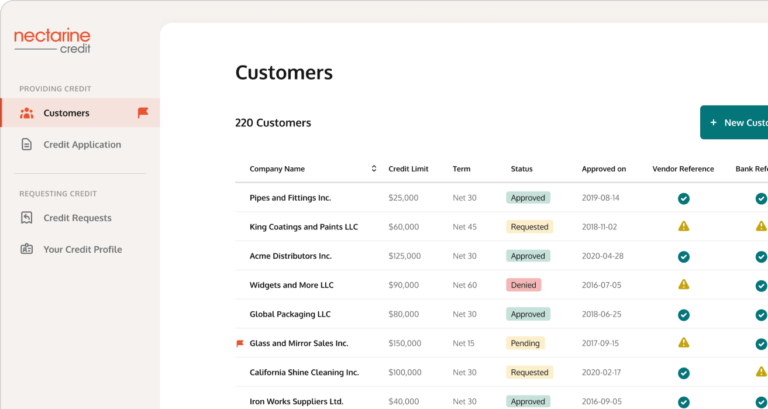

The Victoria-based financial technology startup is in the business of modernizing credit decisioning. The company believes that data automation offers a consistent, fast, and secure process for what is describes as a “critical segment of every successful business.”

“We hear all the time how old credit processes take too much time and resources,” said Alex Armitage, CEO of Nectarine. “Yet those processes still linger in today’s fast-paced environment.”

This month Nectarine Credit announced a partnership with global credit and data risk intelligence firm Creditsafe. The arrangement “amplifies the strengths of both companies and gives their clients solid benefits as a result,” according to a statement issued.

“This partnership is exciting because together we deliver credit decisioning support that’s timely, efficient and accurate,” Armitage stated following an announcement made at the National Association of Credit Management 2022 Credit Congress in Louisville, Kentucky.

“Our goal is to give our clients confidence to make better decisions to reduce risk and drive growth,” he added.

The partnership accelerates credit decisioning automation by leaning on both companies’ individual technology.

“We know business wants to do things differently and we are going to take them forward with this alliance,” said Matthew Debbage, COO of Creditsafe Group. “We see so much opportunity with the Nectarine Credit partnership because of their fresh perspectives and advanced technology offers our clients improved onboarding efficiencies, trade with peace of mind around their credit policies and ultimately, a better customer experience.”

Nectarine Credit customers now have access to Creditsafe data on the platform. And its own automated vendor credit application and approval process work better on Creditsafe’s Decision Engine platform, the startup says.

“We believe it’s time for a better credit decisioning platform,” Armitage declared.

110,000 customers across 160 countries use Creditsafe.

Leave a Reply