In a world that feels increasingly uncertain, parents are seeking greater stability through ways that teach their kids lessons that last.

Since 2021, Mydoh powered by RBCx Ventures has helped parents assist their teens toward making smart money choices.

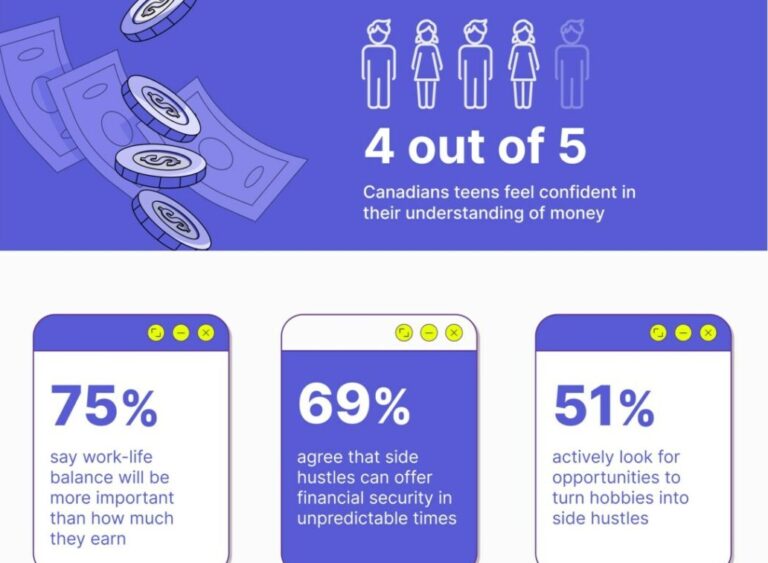

Financial literary tools have gained steam in recent years, and it shows, with more than three-quarters of Canadian teenagers reporting confidence in their understanding of money.

Nearly two-thirds of Canadian teens are saving for their future already, data from a recent Leger survey commissioned for Mydoh shows, with the vast majority stating that they are reluctant to take on any debt in order to buy stuff.

“Teens have seen the effect that rising housing costs, interest rates, and inflation have had on their parents—and the subsequent day-to-day decisions they may have to make to adapt,” suggests Angelique de Montbrun, who serves as chief operating officer at Mydoh, and is also a parent to two teenagers.

Gen Z teens share similar financial concerns as previous generations, including affording a home (79%) and covering major costs like a new car or wedding (69%).

But unlike in the past, discussing money with others is more common.

“Money may feel like a taboo subject for some Canadians, but this generation wants to learn from their parents’ experiences and to take charge of their financial future,” says de Montbrun.

Learning about the various financial aspects of life is something that Gen Z “proactively” pursues.

“With Gen Z’s fast-growing economic power, it is promising to see this generation take ownership of their financial future at a young age,” de Montbrun said.

According to Leger’s survey, 63% of Canadian teens already use modern financial technology platforms and mobile apps to manage money, with a similar number looking to begin investing as early as possible.

“Gen Z are already thinking about building wealth and are investing at a younger age than previous generations,” says de Montbrun.

However, for Gen Z, accumulating as much cash as possible is seldom the goal: 75% say work-life balance is more important in a career than how much they earn, with the vast majority of young Canadians seeing jobs merely as a means to an end.

“Career success is as important to teens as previous generations; however, Gen Z appears to be pushing back against ‘hustle culture’ and prioritizing a better work-life balance,” explains de Montbrun. “While half the teens surveyed say earning a lot of money is important, it is clear that climbing the corporate ladder will not be at the sacrifice of their wellbeing.”

Mydoh has helped more than 140,000 Canadians become more financially literate.

Leave a Reply