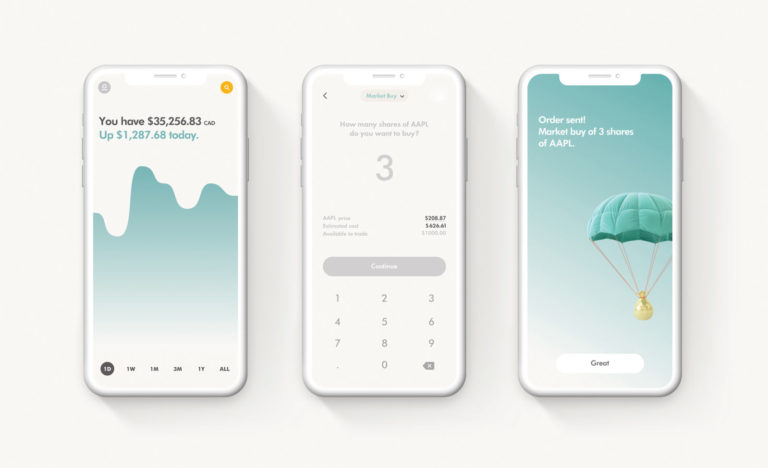

In 2024, Wealthsimple continues to bolster features on its platform.

The steadily growing financial technology firm, founded in Toronto in 2014, has been consistently expanding its offerings over the years—what started as a simple, limited financial app eventually evolved into a do-it-all “super app.”

But Wealthsimple doesn’t want to stop at Super App status. The fintech aspires to be Canada’s next major bank, a true rival to the nation’s Big Five incumbents—or perhaps something even better.

While many older Canadians still bank almost exclusively in-person at brick-and-mortar institutions, a majority of the nation’s younger investors are managing their financial assets using entirely digital processes supported by financial firms that often don’t even attempt to offer physical branches.

This includes Wealthsimple, which has brought out everything from venture capital and private credit offerings to private equity and even stock lending—all from your iPhone.

And in addition to breaking down barriers to institutional-grade investment opportunities, Wealthsimple also bolstered its cash account and added stock lending to its mix of offerings in 2023.

En route Wealthsimple’s stated growth target of $100 billion within five years, the fintech continues to pump out upgrades, enhancements, and enticements in 2024.

This month, for example, the company raised the insurance level of its famous Cash account (which offers up to 5% interest) to an impressive $500,000—up markedly from last year’s boost to $300,000. These kinds of protections may help wary Canadians gain enough trust to make the leap from traditional bank to modern fintech.

Also this year, Wealthsimple added 14,000 symbols to its trading platform and extended its trading hours, among other additions, as the company continues toward its aim of being a fully featured financial institution.

The company has also been toying with the social and gamification side of things, offering “Premium” and “Generation” tiers (based on total assets with Wealthsimple) that offer an interesting mix of tangible financial benefits and status-based perks.

For example, a Generation client (a user with at least $100,000 in assets on the platform) will enjoy a slightly higher interest rate, and lower crypto trading fees, than a standard user, among other differences. They will also receive a different Wealthsimple app icon on their devices that reminds them of their premium status every time they launch the app.

It’s a clever idea, and reflective of Wealthsimple’s approach to compete on essential financial services while finding other ways to stand out from traditional rivals.

Leave a Reply