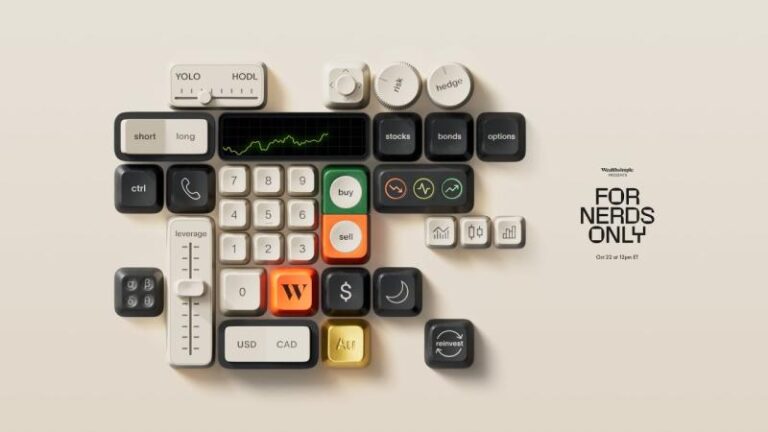

Wealthsimple, the financial services company on a mission to help everyone achieve financial freedom, held the second edition of its product showcase this week, Wealthsimple Presents: For Nerds Only.

The company announced a suite of new innovative investing products and features designed to keep pace with the shifting needs of Canadian investors, claiming that traditional wealth management brokerages aren’t keeping up.

The company announced a suite of new innovative investing products and features designed to keep pace with the shifting needs of Canadian investors, claiming that traditional wealth management brokerages aren’t keeping up.

In an interview with Fintech.ca, Paul Teshima, Chief Commercial Officer at Wealthsimple, unpacks the company’s mission to power the next evolution of investing in Canada.

What are some of the highlights from this second edition of Wealthsimple Presents?

PT: We’ve consistently set the pace for financial innovation in Canada, introducing industry firsts that have reshaped how Canadians build wealth, including being the first regulated crypto trading platform in the country and one of the first financial institutions to bring alternative investments like private credit and private equity to more retail investors.

We launched a ton of new updates to our platform to continue democratizing access to complex investing tools and opportunities that traditional brokerages have kept out of reach.

As of today, we will be the only Canadian brokerage to allow clients to trade real gold, securely and seamlessly in Canadian dollars, starting with as little as $1. Until now, investors who wanted exposure to gold would use gold ETFs or mining stocks, which often come with trade-offs. As physically-backed gold shares offer more direct exposure without owning bars themselves, we’re making that process more accessible through our platform.

We’re also proud to announce the launch of our Retirement Accelerator. Our mission has always been to help Canadians achieve financial freedom, and the Retirement Accelerator is one of the several products we’re introducing to move that mission forward, helping our clients take advantage of earlier market entry in their investing career through a low-interest loan and maximize RRSP contributions.

What is Wealthsimple’s broader mission, and how are these new launches part of that?

PT: We launched over a decade ago to modernize investing in Canada. For too long, Canadians were held back by outdated platforms and generic advice that didn’t reflect their goals or risk tolerance.

Today, the investing landscape has evolved — and so have investors. They’re more confident, engaged, and willing to take control over their own financial futures. But the reality is, many traditional financial institutions haven’t evolved alongside them.

In fact, 79% of the clients we surveyed (aged 25-45 with $50,000+ in investable assets) believe that financial institutions have been slow to innovate, limiting their ability to reach their financial goals.

Our latest launches directly address that gap. They’re designed to give investors greater flexibility, deeper insights, and a more seamless experience — all while keeping the same accessibility and transparency that have defined Wealthsimple from the start.

Wealthsimple claims that traditional brokerages aren’t keeping up with innovation. How are you outcompeting them?

PT: Traditional brokerages were built for a different era of investors. Their systems and service models haven’t evolved at the same pace as the expectations of modern Canadians. Wealthsimple was designed from day one to deliver a faster, more transparent, and more intuitive experience.

We’re outcompeting legacy players by using automation to reduce friction, and continuously adding capabilities Canadians can’t get elsewhere—like 24/7 trading, access to alternative assets, and soon, AI-powered tools that make investing smarter and more personalized.

We move faster, innovate directly from client feedback, and make investing accessible and advanced at the same time.

What’s next for Wealthsimple?

PT: We’re focused on deepening what we already do best: helping Canadians achieve financial freedom through technology.

The next phase is expanding access and sophistication. You’ll see more advanced options strategies and AI-powered insights, among the many other features we plan to roll out through next year.

We’re also continuing to integrate more of our clients’ financial lives under one roof—from investing and saving to taxes, trading, and beyond. Our focus remains the same: to deliver the most modern investing experience in Canada.

Leave a Reply