While many older Canadians still bank almost exclusively in-person at brick-and-mortar institutions, a majority of the nation’s younger investors are managing their financial assets using entirely digital processes supported by financial firms that often don’t even attempt to offer physical branches. [Read more…] about Wealthsimple Appeals to Tomorrow’s Investors with Modern Fintech Platform

News

Montreal’s Nuvei Bolsters Payments Platform with Tokenization Tech

Nuvei Corporation this month announced enhancements to its payment platform.

The upgrades include an advanced network tokenization solution that enables partners to benefit from smoother, more efficient, and more secure transactions in their online checkouts, according to a statement released by the Montreal-based financial technology firm. [Read more…] about Montreal’s Nuvei Bolsters Payments Platform with Tokenization Tech

Canada to Finally Reveal Open Banking Legislation in Upcoming Federal Budget

Next month, Canada unveils its budget for 2024.

The federal government’s annual economic blueprint is expected to include a long-anticipated framework for open banking. [Read more…] about Canada to Finally Reveal Open Banking Legislation in Upcoming Federal Budget

San Francisco Fintech Finix Launches Unified Payments Platform in Canada

A California-based payments technology provider for businesses is marching North.

San Francisco’s Finix announced this week that its suite of unified payment offerings is now available in Canada. [Read more…] about San Francisco Fintech Finix Launches Unified Payments Platform in Canada

TD Bank Collaborates with SideDrawer to Innovate Fintech in Canada

One of Canada’s major banks this week unveiled a partnership with Toronto’s SideDrawer, an API-based digital vault platform. [Read more…] about TD Bank Collaborates with SideDrawer to Innovate Fintech in Canada

PayShepherd Secures $7M to Bring Financial Technology to Heavy Industry

A Calgary-based innovator of financial services for heavy industry today announced an oversubscribed “seed+” round of funding. [Read more…] about PayShepherd Secures $7M to Bring Financial Technology to Heavy Industry

Visa Unveils New Manager for Canada at ‘Time of Opportunity’ in Fintech

Visa this week announced the appointment of Michiel Wielhouwer to President and Country Manager for Visa Canada.

Wielhouwer joins Visa Canada “at a time of growth and opportunity,” according to the company, as it establishes new ways to pay driven by innovation in financial technologies. [Read more…] about Visa Unveils New Manager for Canada at ‘Time of Opportunity’ in Fintech

Bloom Unveils Latest Fintech Feature Aimed at Canada’s Retired Homeowners

A Canadian financial technology firm today introduced a payment card targeting Canadian homeowners aged 55 and older.

Toronto’s Bloom Finance says that its new Bloom Home Equity Prepaid Mastercard addresses a “pressing need for innovation within the financial landscape for . . . the unique requirements of Canadian retirees who own their homes.” [Read more…] about Bloom Unveils Latest Fintech Feature Aimed at Canada’s Retired Homeowners

Montreal’s Shakepay Unveils New Hire as Fintech Advances Canadian Crypto

A Canadian financial technology upstart this week announced a strategic hire.

Montreal-based Shakepay, which offers a crypto trading platform among other products, has hired Eric Richmond as the company’s new General Counsel and Head of Business Development, the company has revealed. [Read more…] about Montreal’s Shakepay Unveils New Hire as Fintech Advances Canadian Crypto

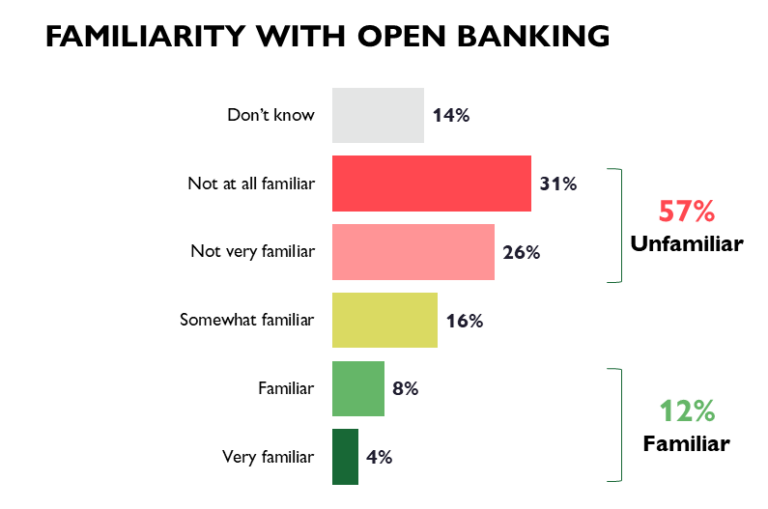

Canadians Still Unfamiliar with Open Banking in 2024 Amid Limited Progress

Canadians continue to be either unaware of, or confused by, the concept of open banking.

As Canada’s government continues to lag behind the US, UK, and other regions on adopting open banking, private companies have been doing what they can to push the protocol forward. [Read more…] about Canadians Still Unfamiliar with Open Banking in 2024 Amid Limited Progress