Open Banking is a globally growing financial services trend that enables financial data to be shared, with the consent of the consumer, with authorized third-party service providers (TPPs). It is intended to be a more secure framework for data sharing through secure channels such as Application Programming Interfaces (APIs), moving away from current data sharing methods such as screen scraping and credential sharing. [Read more…] about Navigating Open Banking: Canada’s Journey Toward Implementation and the Road to a Hybrid Model

News

Fintech Solution Targets Debt Difficulty Among Canadian Students

Canada is home is one of the world’s most educated workforces.

But a stark new poll from a Canadian education savings and planning company spotlights financial challenges and concerns facing post-secondary students across the country. [Read more…] about Fintech Solution Targets Debt Difficulty Among Canadian Students

Canadian Fintech Not Taking Advantage of High-Performance Computing, Survey Finds

A high performance computing infrastructure provider this month announced the results of a survey that explored IT professionals’ views on how emerging technologies will affect data centres in the future. [Read more…] about Canadian Fintech Not Taking Advantage of High-Performance Computing, Survey Finds

APX Launches Bitcoin-Backed Lending Platform for Consumers, Banks

At this month’s 2023 Futurist Blockchain Conference in Ontario, APX Lending announced its official launch. [Read more…] about APX Launches Bitcoin-Backed Lending Platform for Consumers, Banks

TTC Partners with Moneris to Introduce Credit and Debit Card Options

The Ontario government is making it easier to take transit by giving riders more ways to pay on the Toronto Transit Commission (TTC). Riders can now use credit or debit cards to pay fares, including cards on a smartphone or smartwatch. [Read more…] about TTC Partners with Moneris to Introduce Credit and Debit Card Options

Why Every Fintech Should Be Thinking About Digital Verification

In today’s digitalized environment, trust forms the foundation of business relationships, especially when personal information is at stake. A PwC survey found 91% of business executives acknowledge that trust enhances the bottom line. [Read more…] about Why Every Fintech Should Be Thinking About Digital Verification

Mydoh Empowers Canadian Parents and Teens with Lasting Financial Lessons

In a world that feels increasingly uncertain, parents are seeking greater stability through ways that teach their kids lessons that last.

Since 2021, Mydoh – powered by RBCx Ventures– has made it easy for parents to help teens make smart money choices and fuel their passions. [Read more…] about Mydoh Empowers Canadian Parents and Teens with Lasting Financial Lessons

How Fintech is Positioned to Fuel Canada’s ‘Phygital’ Era of Real Estate

An emerging opportunity for fintech may lie in the real estate sector’s leap toward a “phygital” era.

Already, there are numerous prop tech startups in Canada innovating various aspects of real estate. [Read more…] about How Fintech is Positioned to Fuel Canada’s ‘Phygital’ Era of Real Estate

Calgary Emerging as Canadian Fintech Hub

As one of the world’s largest financial technology hubs, Toronto is duly associated with Canadian fintech.

But other regions of the country have their own fintech fitness, such as Vancouver. [Read more…] about Calgary Emerging as Canadian Fintech Hub

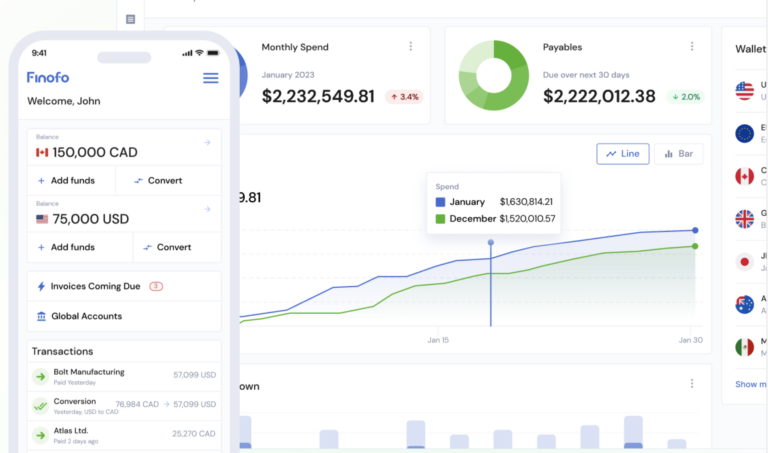

Finofo Draws Investment for ‘Only Fintech Platform a Business Should Ever Need’

Finofo announced this week pre-seed funding.

The Calgary-based financial technology startup wants to reduce the headache and complexity around foreign exchange rates for cross-border businesses. [Read more…] about Finofo Draws Investment for ‘Only Fintech Platform a Business Should Ever Need’