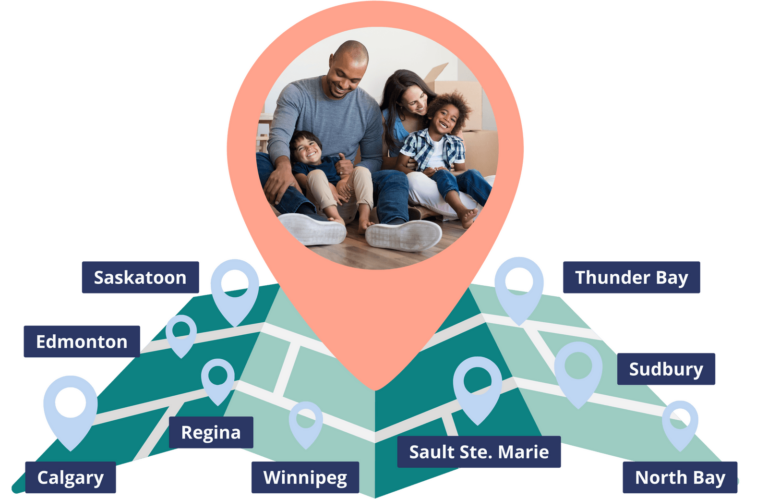

A property technology firm based in Toronto today announced the closing of $26 million in equity and debt financing.

On a mission to make homeownership more accessible, Requity Homes secured capital from Highline Beta, Boardwalk Investment, Conconi Growth Partners, the Archangel Adrenaline Fund, and an array of angel investors—including financial services executive Mike Dobbins, who joins Requity’s board of directors. [Read more…] about Requity Homes Raises $26M to Power Rent-to-Own Pipeline Across Canada